Is the ERC Program going to end early?

There has been a lot of conversation about the government shutting down the Employee Retention Credit Program ending before April 15, 2024.

In this post, we will look at the latest ERC program updates and facts.

Watch the short version [2 minutes, 40 seconds] in the video below:

ERC Program Update 2024

The ERC/SETC claim process has included many twists and turns. The Tax Relief for American Families and Workers Act of 2024 to end the ERC program has been passed by the House of Representatives, but it is not law yet. It must go to vote and be passed by the Senate. This vote has not been scheduled. There are many rumors including that if it is passed, it will be retroactive to January 31st, 2024.

When does employee retention credit end?

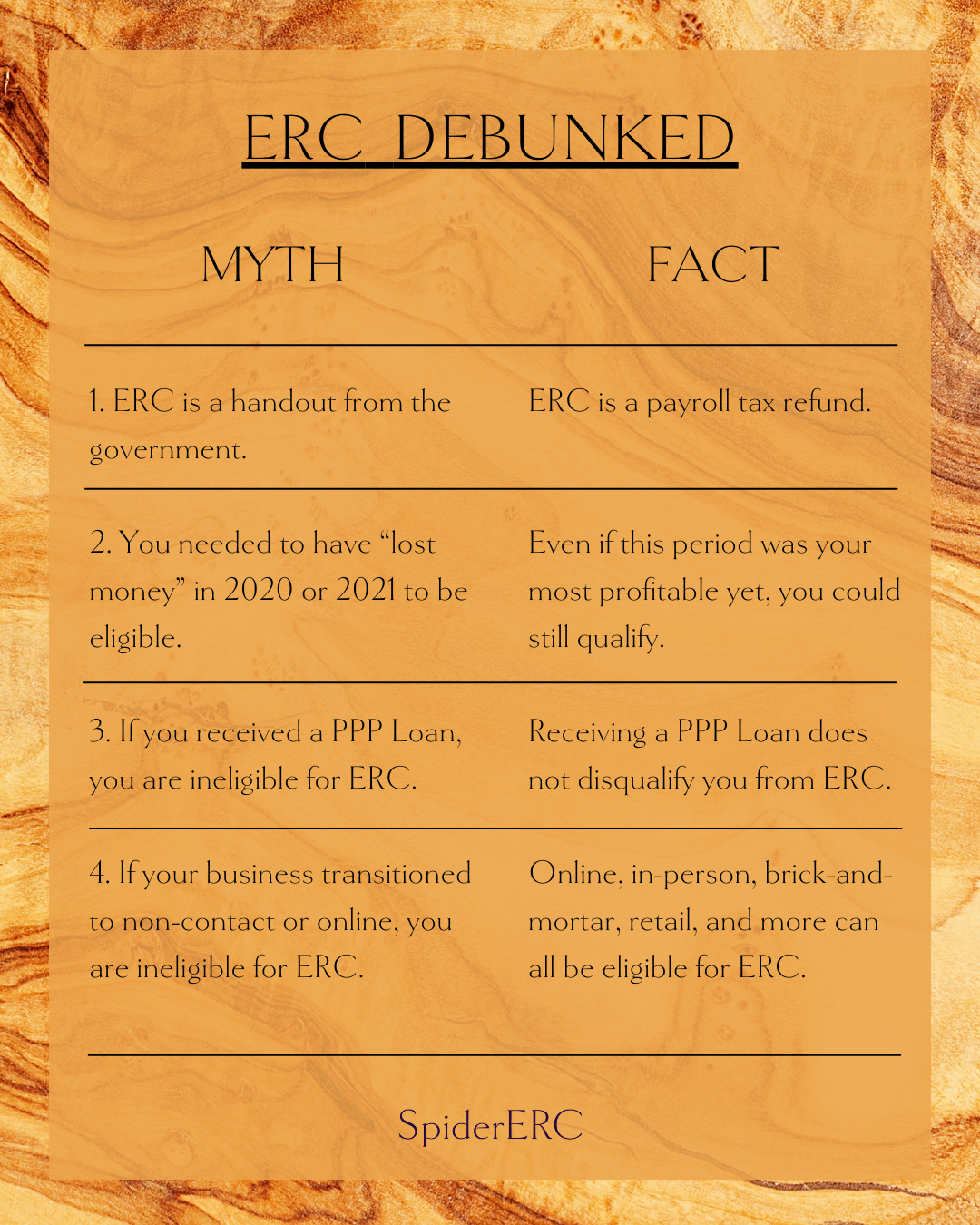

The truth is, no one actually knows if it will pass and when it will become law. It is predicted that the Senate will vote this bill down. This program has always been a once in a lifetime legislation and it is why we have worked so hard to educate and get the message out about ERC through the sea of fraudulent companies creating fear about this program. This is not “free money” or a government handout. This is an overpayment of taxes by businesses owners during COVID.

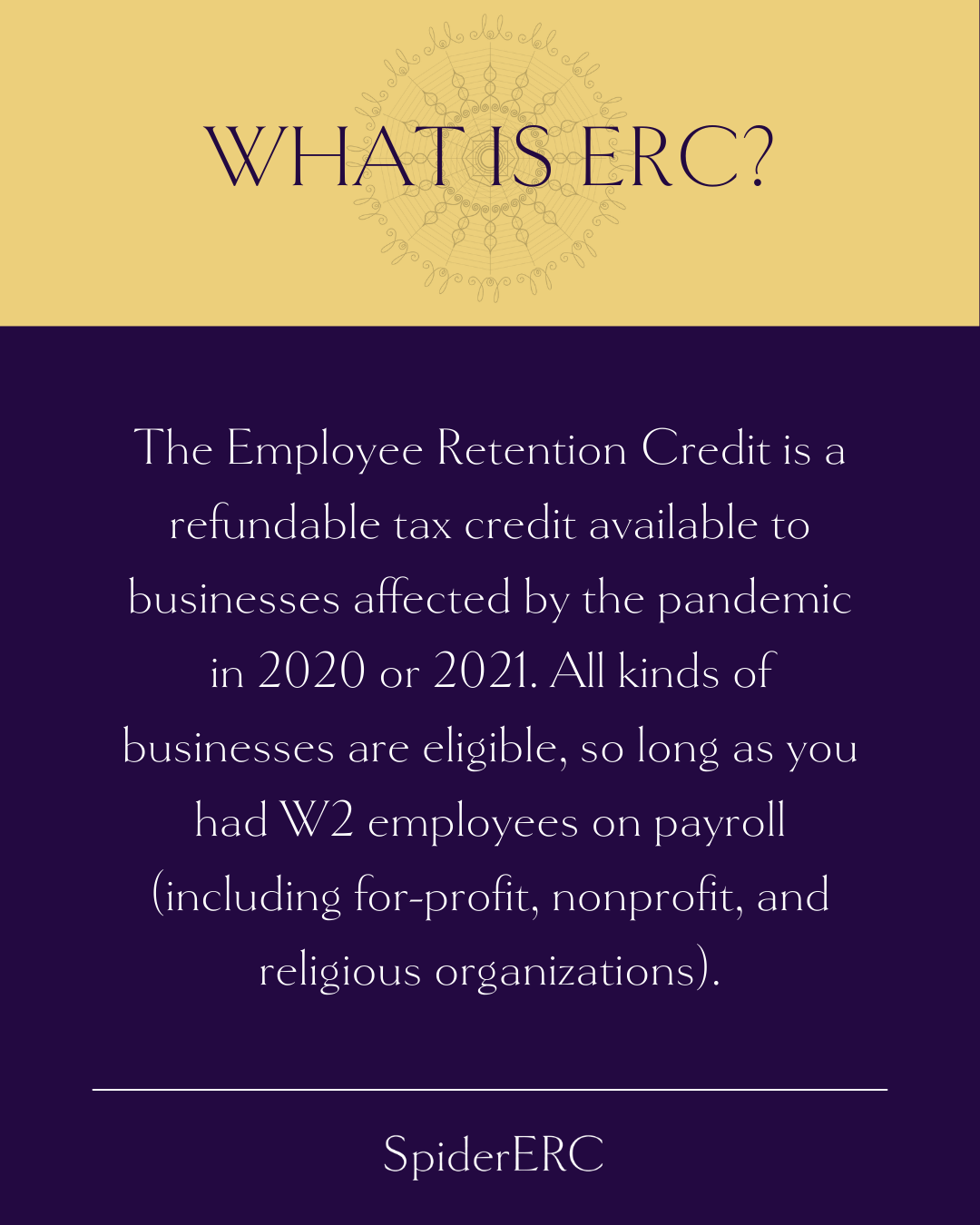

To recap, what is the Employee Retention Credit?

The Employee Retention Credit is a refundable tax credit available to businesses affected by the pandemic in 2020 or 2021. All kinds of businesses are eligible, so long as you had W2 employees on payroll (including for-profit, nonprofit, and religious organizations).

The original legislation was intended to reward organizations who kept this country running by keeping people employed. Often this was done during near impossible circumstances for some industries. Congress forced the IRS to administer this program and they were undertrained and understaffed to do so.

So now we have a situation where the IRS is invested in convincing people to not apply. The government wants it to end so they can redirect the $70+ billion dollars other places. Some of these types of actions are not new. The part that is new is what matters most — that $70+ billion is an overpayment of taxes. It belongs to the businesses who overpaid, businesses who will need that money back in these uncertain times. We can’t stop the government from passing a law saying they are keeping the money. What we can do is to ask you to spread the word to each and every business you know and love to get their claim in before this opportunity is gone.

Who qualifies for the Employee Retention Credit?

You may be eligible for ERC if:

- You had W2 employees in 2020 or 2021

- You stayed open during that time, and continued to pay employees

- You were impacted by the pandemic in some way (either a financial loss, temporary closure mandates, or supply chain disruptions)

What types of businesses can file for the ERC?

The following types of businesses can be eligible for the Employee Retention Credit:

- For-profit businesses (Online or Brick-and-Mortar)

- Nonprofit organizations

- Religious organizations (Churches, Synagogues, etc)

Why are many ERC companies are shutting down?

The current bill intended to shut down the ERC program includes a piece to directly go after and prosecute ERC companies they call “promoters.” We have never wavered in our commitment to you and the businesses of this country. Why? Because we stand by our work. We only file legitimate claims. We verify in great detail every aspect of the business operations that makes an organization qualify. We prepare a report with detailed documentation for every claim. We promise those who work with us to get them every penny they deserve and not a penny more.

Numerous companies have come to us — as an expert in ERC — to review their already filed claims. We found that some claims were overestimated and these companies now have a chance to fix it before an audit. Most were underpaid. But more importantly, what they did file was done wrong. In nearly every claim we have audited, the law was applied incorrectly and we found gross errors.

What are the chances of an ERC claim triggering an audit?

While we can’t speak to chances of an audit in terms of percentages, what we can say is this: collectively as a team, we have filed over a billion dollars in ERC and SpiderERC has never had a single audit. We have worked closely with the IRS to support and actually provide training to some of their agents.

When you are telling the truth and following the letter of the law, there is no need to fear an audit. We are still standing as a company alongside you, the business owners, and we will be here long after the program ends if you need anything. All we ask is for you to stand with us and get the word out.

The Facts: ERC

If you haven’t signed your claim or filed do so right away. We are still submitting claims until the program is eliminated.

- If you filed before September 14th, 2023 your claim will be processed and paid first.

- The IRS has not sent checks since September 2023 and are still on hold.

- If you filed before January 31, 2024 your claim will eventually get processed and paid, but there is no information from the IRS regarding timeline.

- You will be earning interest on your valid claim until paid out (YES, this time the IRS will be PAYING YOU interest!)

- If your claim was over $75,000, we have a financing partner that may be able to get you up to 70% of your money to you now. Contact us if interested.

- If you have submitted a claim, make sure you have the correct mailing address on file with the IRS of where you want your checks to be mailed. (You can use Form 8822 to update your address)

- You will receive a separate check for each quarter you qualify for.

The Facts: SETC

The Self Employment Tax Credit, or SETC, is another program we administer claims for. This program has not been included in the bill before Congress and remains available for filing. This program is the self-employed or 1099 version of ERC. If you claimed self-employment income in 2020 and 2021 and you want to apply for SETC, contact us.

For those of you who have already filed your SETC claim, we have an update for you. The IRS froze all e-filing in November 2023. They were uncommunicative about when they would reopen it, making it impossible for us to provide updates. They have recently reopened e-filing again, and all of your claims will be submitted in the next two weeks. With all of the ERC craze, the government and IRS provided no information until recently. We greatly appreciate your patience with us and want to assure you that your claims are a high priority.

How to apply for the Employee Retention Credit?

Our team of ERC Experts is available to support you with the qualification and filing process. Get started by filling out the ERC pre-qualification form here.

For our prospective clients, we thank you for trusting us to be your claims processing partner and for your willingness to invest the time in the qualification process.

For our existing clients, we look forward to hearing from you when your checks arrive and celebrating with you. Please reach out if you have any questions, concerns, or people you would like to refer.

Feel free to send this blog post to anyone who may be interested.