COVID RELIEF TAX CREDITS

ACCESS ~ EXCELLENCE ~ PERSONALIZED CARE

WELCOME TO SPIDER ERC

In 2020, Congress passed the CARES Act. This legislation included the initial Employee Retention Credit guidelines. There was $1.7 trillion allocated for ERC funding. If your business, religious institution, or nonprofit had W2 employees in 2020 or 2021, chances are you are eligible — even if you received a PPP loan, and even if you didn’t lose money. The ERC is designed to reward organizations that weathered the storm of the COVID-19 pandemic.

This program, however, was created in such a way that only big corporations with a team of lawyers and tax specialists were able to apply. They made the rules for receiving ERC incredibly convoluted and just about impossible for the average business owner to decipher and access this once-in-a-lifetime legislation. This was unacceptable to us. We believe ALL businesses that kept people employed and our country running during this time of crisis deserve an equal opportunity to apply for this financial relief owed to them. This is why we created Spider ERC.

Our team has collectively filed over 2000 claims equalling over a billion dollars. Not one SpiderERC client has ever been audited. Peace of mind for our clients is just as important to us as the precision of the technical services we provide.

In September 2023, the IRS released a statement announcing a ‘pause’ in processing claims and greater scrutiny and audits of the process due to the high amount of fraudulent and exaggerated claims by many fly-by-night ERC companies. We at Spider are happy that the IRS statements released have cleared out fake companies and claimants who intend to place fraudulent claims. In actuality, there is no need to falsify or stretch the truth on any ERC claims because the law is written in such a way that it is quite generous and clear on what is a real claim and what is not. SpiderERC understands and applies these rules to the letter of the law and we provide extensive documentation to support your claim.

We get our clients every penny they are entitled to and not a penny more. We are doing for our clients what best-in-class accountants do for their high net-worth clients: utilize the law to safely generate and build their clients’ wealth and legacy. We are insured for over one million dollars per incident and have never had a single audit of any of our claims.

We are here to answer any questions. If you have friends or family who want to file and are afraid or believe their claim may have been done incorrectly by another company, please feel free to have them reach out to us.

YOU MAY QUALIFY IF…

- You experienced at least a 20% loss in quarterly revenue in 2020 or 2021 compared with the same quarter in 2019, or

- You had to partially suspend business operations due to government-ordered pandemic restrictions, such as capacity limits, social distancing requirements, travel restrictions, or temporary closures or shutdowns.

There’s a common misconception that the ERC is available only to businesses that had to shut down entirely, or to essential businesses, or to businesses that didn’t receive a PPP loan. This is not the case! You can find out if your business qualifies for the ERC free of charge by filling out our pre-qualification form.

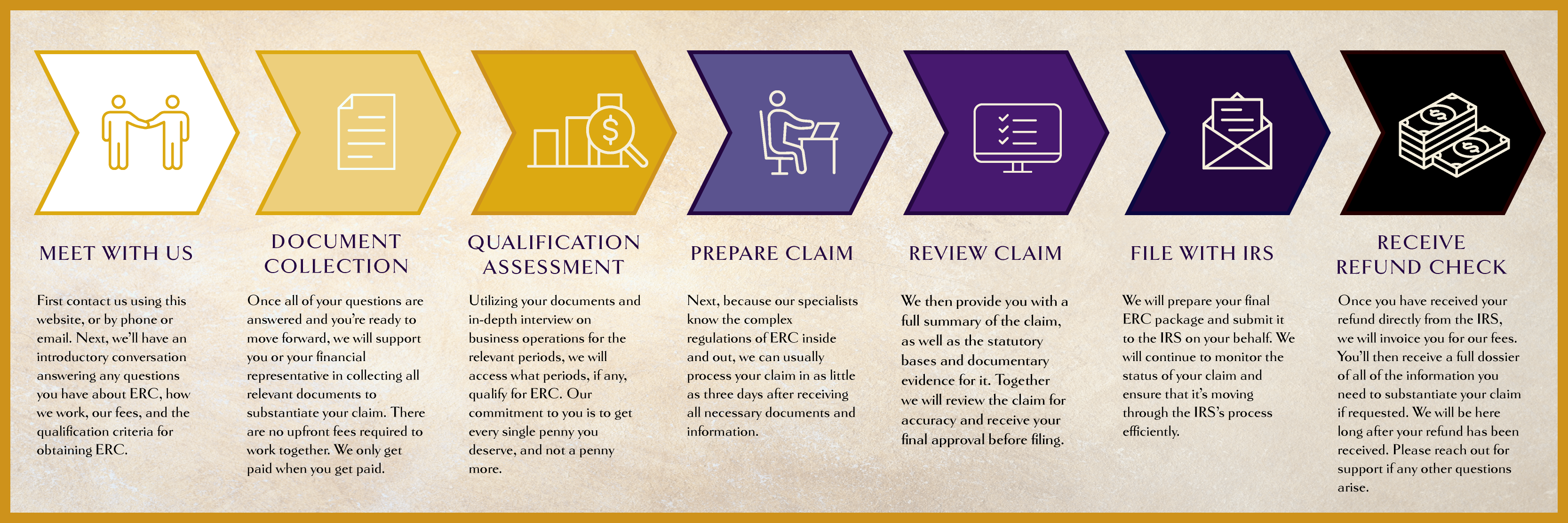

OUR ERC CLAIM PROCESS

SpiderERC is a solid team for claiming ERC credits. They really helped me out - legit, fast, professional. I had “ERC” on my to-do list for months and it ended up being way easier than I thought. I’m so grateful Spider helped me through the overwhelm so I didn’t miss this opportunity. I have been telling all my business owner friends about it.

Katie Hess // Founder, LOTUSWEI

I recently consulted with Eric and Michelle and the Spider ERC team on my SETC (self-employment tax credit) filing. As an acupuncturist and small business owner, every credit I'm eligible to receive can make a really big difference. Within less than 30 minutes they were able to determine what tax credit amounts I was eligible to receive, and the filing (paperwork) was completed in less than a week. The whole process was simple and straightforward, and the team at Spider was extremely professional and caring. It was such a pleasure to find a company with heart and integrity that goes above and beyond to do an excellent job. Thank you!

Jenni Lund, M.Ac., L.Ac. // Jenni Lund Acupuncture

I just hopped off my qualification call with Oscar and I want to shout about Spider and the SETC program from the rooftops! in 18 minutes on the phone together, Oscar clearly showed me I qualified for a little over $19,000. Spider previously helped a couple of my web design clients get nearly $72,000 in ERC refunds, so I was over the damn moon when they told me there was a pandemic tax credit for self-employed business owners too… I just had no idea it would be this kind of number. if you’re on the fence about SETC or Spider, get off the dang fence and hop on a qualification call. It may be the most profitable 18 minutes of your business yet.

Lucy Ross // Hello Lucy Creative Studio

I didn’t know that nonprofit organizations can qualify for this credit. This will make a huge difference for us.

Sheila Weinstein // Beth Israel Synagogue

SpiderERC made this confusing process extremely painless. I had no idea I was eligible for this credit in the first place. They explained it to me patiently and took care of everything.

Jeremy Sullivan // Gym Owner

I thought I'd have to pay my accountant thousands of dollars to get this tax credit, but SpiderERC got to work for free and processed everything in no time. Strongly recommend!

Steve Raczinski // Owner, Mercury HVAC

CONTACT

Prefer to reach out directly? We’d love to hear from you. Feel free to call us at 833-418-3509 or email us at Info@SpiderERC.com.